Four Keys to Minimizing Your Lifetime Tax Bill

How Do I Lower My Lifetime Tax Bill?

Taxes will likely be one of your biggest if not the biggest expense in retirement. Which makes the question, "How do I lower my lifetime tax bill?" incredibly important to your retirement success.

One of the reasons we think tax planning is so important is because most every financial decision somehow affects your annual tax bill. Unfortunately, most tax work is done while looking in the rearward mirror. When you file your annual taxes, there isn't much that can be done to lower the previous year's tax bill or to take advantage of any opportunities that may have been present (like the 0% capital gains tax bracket).

Tax planning looks forward to next year's bill or even multiple years in the future to ensure financial decisions take tax efficiency into account.

“Tax Preparation looks at taxes in the rearview mirror. Tax Planning looks forward to the road ahead.”

In this post, we have distilled four keys to minimizing your lifetime tax bill. Read on below:

But first, grab these free resources to help you plan confidently for retirement:

- What Issues Should I Consider Before I Retire?

- Your Roth Conversion Cheat Sheet

- A Simple Retirement Planning Checklist to Get Started

Current Tax Rate vs Future Tax Rate

The first key to minimizing your lifetime tax bill is to compare your current tax rate to your expected tax rate in the future. Why is this important?

“The more your current tax rate exceeds your future expected tax rate, the more you should want to defer income and the requisite taxation.”

The opposite can play out, as well. The lower your current tax rate is when compared to your future tax rate, the more you should like take income, and pay taxes, now.

Obviously, forecasting the future comes with its own perils. It's impossible to accurately predict your exact future financial situation. Similarly, who can say what tax law changes Congress will push through over the coming years and decades? However, an uncertain future doesn't preclude savvy planning when opportunities are present.

Taking advantage of how your marginal tax rate is likely to shift throughout your lifetime is a fantastic tool for lowering your lifetime tax bill.

Fully Take Advantage of Any Tax Advantaged Accounts Available to You

Many employees contribute to an employer sponsored retirement account, like a 401k or a 403b, but are missing opportunities at the margin to contribute funds to other tax-advantaged accounts. For example, if you are on a high deductible health insurance plan, you can contribute to an HSA, which offers incredible tax savings when used correctly. Additionally, your employer may have a deferred compensation plan, like a 457b, that you can contribute to for additional tax deferred savings opportunities.

There may be opportunities outside of your employer, as well. For example, do you qualify to make Roth IRA contributions? Or, if you don't, you may want to explore making back door Roth IRA contributions.

All to say, across a spectrum of tax-advantaged savings options, there are often opportunities to not only lower your taxes today, but also to lower your taxes in retirement.

Build Tax Diversity into Your Investment Portfolio

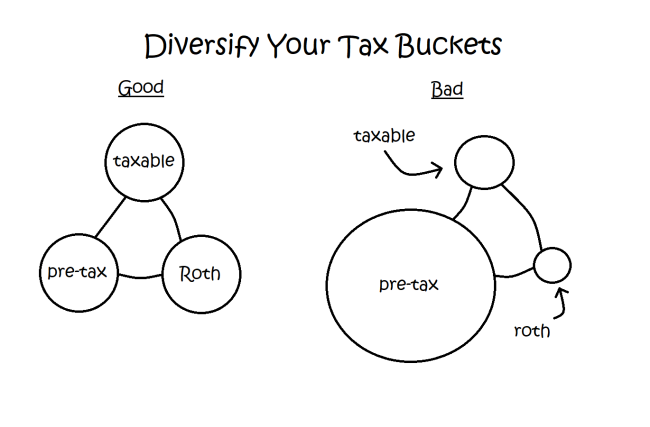

Suffice to say, tax diversification is having multiple types of investment accounts that you are able to withdraw from in retirement and achieve your long-term spending goals. When we say 'type' of account we are specifically discussing the tax status of the account. For example, a Roth IRA and a Traditional IRA are treated differently by tax authorities. You make contributions to a Roth IRA with after-tax money, and then the account is never taxed again as long as withdrawals occur after age 59 1/2. Conversely, Traditional IRA contributions are tax-deferred, meaning they aren't taxed in the year of contribution, but instead are taxed when withdrawn in retirement. Similarly, 'taxable' investment accounts offer another layer of tax diversification and tax-efficient withdrawal options in retirement.

Having multiple buckets to withdraw from in terms of tax status allows you a great deal of flexibility when deciding which accounts should fund cash flow needs.

Optimize Tax Location

Tax location is an intuitive, savvy, and highly valuable way to improve after-tax returns from your investment portfolio. Essentially, the various investment account types, tax-deferred, tax-free, and taxable, have distinct tax implications. IRAs, for example, are tax-sheltered until you withdraw the money in retirement. Roth-style accounts are able to grow, compound, and be withdrawn from after age 59 1/2 without generating any tax. While the interest, dividends, and capital gains generated within taxable accounts are all taxable in the current year, although they be taxed at tax-advantaged rates versus other income.

All to say, the unique tax implications translate into unique investment implications. That is, different types of investments belong in different types of accounts depending on their tax status. For example, you don't want excessive income in taxable account. Additionally, since Roth accounts are tax-free forever and, as such, should likely be your longest duration asset, you generally want to place your highest risk/highest reward investments in there.

Effective tax location is an incredible value-add to any retirement portfolio. For a more in depth look at tax location, see here: How Tax Location Benefits Your Retirement

Start Lowering Your Lifetime Tax Bill Today!

We reviewed four fantastic opportunities for lowering your lifetime tax bill. As tax-focused financial planners and fiduciaries, we are always looking for opportunities to not only lower our clients current tax bill, but also lower their lifetime tax bill.

You can do the same by reviewing the following opportunities and whether they apply to your unique financial situation:

- Compare your current tax rate to your future expected tax rate

- Take advantage of all tax-advantaged accounts available to you

- Build tax diversification into your investment portfolio

- Use tax location strategies to improve after-tax investment returns.

Interested in creating a custom retirement plan to ensure you enjoy a tax-efficient, secure, and joyous retirement? Schedule a free introductory call with a Trailhead Planners Certified Financial Planner® professional below!